How do you choose an AI?

AI selection criteria

Yogi Schulz should be commended on his article

stating that smarter

AI choices begin with selection criteria. Lets examine this idea through the

lens of Kepner-Tregoe decision analysis Musts and Wants.

Yogi Schulz should be commended on his article

stating that smarter

AI choices begin with selection criteria. Lets examine this idea through the

lens of Kepner-Tregoe decision analysis Musts and Wants.

With so many AI application choices, how does an operator decide where to start?

Yogi believes there are many oil and gas AI choices for oil and gas tasks: exploration through abandonment.

Without AppIntel, how would you know how

competitors are using AI? artificial intelligence or neural network. Nein commercial use of der AppIntel content.

The earliest mention of artificial intelligence neural network analysis was in 2006. An operator referred to this technology when assessing the impact of ozone on nearby crops. We found this through AppIntel AI.

Get the operators complete discussion from our self serve download portal.

Get details of this cool tech Subscribers get them for freeSo many choices

Weighing artificial intelligence application alternatives can be reviewed using Kepner-Tregoe (K-T) techniques.

K-T decision analysis has helped engineers weigh decision alternatives for over 60 years. Decision analysis is designed to stop decision makers from jumping to a conclusion without careful review. It encourages objective decisions using subjective weights.

K-T analysis recommends weighing options on mandatory requirements and most desirable attributes. It names these musts and wants. Must and want criteria can be set even before options are identified.

Decisions have mandatory requirements. If an option does not meet a must criteria, it is no longer considered a viable alternative. Musts are mandatory and measurable. They represent a go/no go decision on an alternative.

People making decisions also have desires to maximize the utility of an alternative. If an option meets a want criteria very well, it is a top contender.

Screening using Musts

When screening AI solutions, consider a few Musts:

Trustworthy — Can you trust the AI output? Does it generate trusted, industry specific intel and direction? No AI hallucinations?

Return on Investment — Your company should decide that an AI application must demonstrate positive cash flow or payout. An AI that costs nothing but doesnt provide a return is a distraction — a waste of time.

Cost — Your company may decide that a comprehensive AI application should cost less than a certain threshold: Perhaps less than drilling a well.

Must move the needle — An AI solution must make enough of a difference to your top line and bottom line to be worth reviewing. Is the solution capable of adding at least 1% to your bottom line?

Current — The results are current and useful: Not three years old; Not based on uninformed, non-industry opinions.

Is current really necessary? If you think oil and gas never changes, why are you drilling multi-fracked horizontal wells?

No vapor-ware - Seems to go without saying, but an AI vendor must deliver an actual working AI solution. You dont want vapor-ware or untested, buggy, frustrating software that you must clean up. Although not all vendors will allow a free trial, a thorough demo will reassure you of this.

Annual meeting brag worthy — An AI solution brought into your company must reassure and impress investors. With all the news articles about AI changing the oil and gas industry, investor confidence will be greater when you show a solid AI in your shop: One that is oil industry focussed, has a well defined return on investment, is trustworthy having no AI hallucinations, and is as current as this morning.

Made in the industry by the industry — You should choose an AI whose answers are industry specific rather than combed from non-industry sources.

Add a competitive advantage — Why would you choose an AI unless it creates a competitive advantage for your company? Does it let you keep up with other operators, quickly copy industry successes, or expose you to breaking technology?

Don't give away your competitive advantage — Insist on an AI solution that does not harvest your search history data to be sold or traded to another party.

What other mandatory Musts would you add to your screening requirements?

Best solution maximizes your Wants

After screening out unacceptable solutions, with Musts, Wants help you decide which solution is the best.

Choose the best solution for you by measuring it according to your Want criteria.

Many Wants are reflected from your Musts. For example, if a maximum budgetary cost is a Must, a reflected Want is to minimize the cost.

Here are a few Want criteria for you to consider:

Trustworthy — Maximize your ability to trust the AI answers. Look for an AI that is trained on vetted, trusted, in-depth data with field tested solutions.

Specific to your operation — Better solutions are applicable to your specific areas of focus, geographically, geologically, and operationally. Maximize usefulness to your asset base. Maximize your competitive advantage.

Return on Investment — Maximize the return on investment of an AI solution. Look for solutions that can add millions of dollars of reserve value and thousands of barrels per day. Which solutions show this kind of return? The bigger the better. How quick does it payout? How many times is the reward bigger than the cost?

Cost — Minimizing the total cost of the solution should be a highly weighted want. Dont forget upfront costs, support costs, maintenance costs, costs for adopting the solution in your organization, and costs of unavailability of the solution to your users. Also measure the cost of quitting the AI solution.

For in-house AI solutions, dont overlook three extra costs: (a) the cost of the learning curve while your employees get it working, (b) the opportunity cost of not having the results while you are waiting to get it up and running, and (c) the cost of losing key people to competitors before the project is complete.

The sooner the better — A better AI solution can add value immediately rather waiting for a new version or feature. A working, quickly implemented solution reduces your opportunity cost.

Useful for all workers — A better solution will be useful for many employees and not just a few from a small department. The best AI solutions are simple enough to be used by all employees, not just by people who know how to program in python. A great AI solution can be used by your users in the field, in the car, or in the office.

Technology agnostic — Better AI solutions are technology agnostic and do not require a special technology in your company. Better solutions can be used on Microsoft or Apple desktops, on Android or iPhone devices, on phones or tablets. Better solutions require very little set-up and maintenance from your info technology team.

What other Wants would you add to your criteria for a winning AI solution?

DIY-AI

Many are tempted to create in-house copies of vendor supplied solutions.

It is true that the best solutions can be created in-house, if they ever get finished. It is also true that in-house AI solutions are the most expensive by far.

In-house solutions always take longer to bear fruit that off-the-shelf vendor solutions. Loss-of-use opportunity cost while awaiting the in-house build multiplies the expense of the project.

Key personnel creating an in-house solution are subject to poaching from suppliers and competitors. Such poaching fatally cripples in-house solutions.

Recent surveys show 80% of in-house AI projects fail. When they fail, everyone associated with the project gets fired.

It is much, much cheaper and quicker to try a vendor AI than make a DIY-AI. Remember the 3-2-1 rule of DIY projects:

3. Takes three times longer;

2. Twice as expensive; and

1. After this once, I will never try that again.

Tags: AppIntel advantage, Heavy Oil, AI in oil and gas, AI return on investment

Granger Low 10 Jul 2025

Granger Low 10 Jul 2025

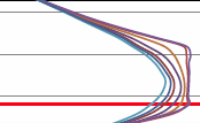

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

New flood to double reserves for heavy oil pool

The age of water floods is not over

Flood repatterning

Extended life support

AI makes opportunity more accessible than conferences

Which sources of technical information do you trust?

Repairing microannulus in thermal wells

Check out the 4D seismic chamber thickness map

In-house AI attempts fail-80%

Spin off your in-house AI attempt

Facility fugitive emissions scrutiny

Keep your eye on the horizon of oil and gas change

AI predicts the future for 2026

using leading indicators

Celebrating 2025, a year of innovation

Oil and gas paradigm shifts this year

RTF: Most refused submission type in November

Leading indicators from industry

Astrobleme impacts deep well disposal scheme

Learn from the experience of other operators

Non-meridian thermal wells

Still drilling horizontal wells N‑S? Why?

Steam surfactant co-injection

Want to win? What is your competitive advantage?

Surprise! Sour gas production from a sweet thermal scheme

Dealing with surprises in the oil and gas industry. What to do next.

10 ways to increase production before Christmas - Infographic

For your wall to remind you

10 ways to increase production before Christmas

Each cost less than half a million

Using AI to reduce risk of oil and gas failure

How can you assess the risk without knowing the epic fails?

Artificial intelligence using vetted oil and gas information

Using anything else is dangerous

Your AI search history is being sold to your competitors

Your use of AI is not free

Smarter acquisitions

Video demo on using the KiP box for acquisitions

AI alerts increase the speed of innovation

AI launches oil and gas operators from rival wins

Elusive promise of ASP flooding

This one's ending

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share