Flood still not optimized? The opportunity cost is high.

Deciding where to invest? Optimizing floods provides the best return in the basin.

Optimizing floods is a much cheaper way to increase production than drilling. If you ignore flood optimization you face a huge opportunity cost.

Deciding where to invest? Optimizing floods provides the best return in the basin.

Optimizing floods is a much cheaper way to increase production than drilling. If you ignore flood optimization you face a huge opportunity cost.

Opportunity cost is the rate of return of the next most attractive alternative.

This blog post is brought to you by Proven Reserves Exploitation, one of our information partners. Nein commercial use of der AppIntel content.

One operator chose to drill a well in a costly, restricted area because he expected a large prize -- even on a risked basis. The opportunity cost was the smaller return of drilling wells in an easier locale. So he decided to drill this expensive critically sour well in a recreational area taking all the extra environmental care and bearing the extra cost.

See his drilling plans in his application documents from our self-serve portal.

Buy these submission docs now Subscribers get them for freeLosing cash flow by not optimizing a flood: Opportunity cost

For every month an operator puts off optimizing her flood she forfeits the opportunity cost of half a million dollars or 300 bopd.

| If an operator chooses not to optimize a flood, the opportunity cost is $500k/month | ||

| 300 | bopd | Incr prod |

| $6,000 | k cf/y | Incr cash flow |

| $500 | k cf/mo | Incr cash flow |

| $500 | k cf/mo | Opportunity cost |

The opportunity cost is the lost cash flow from deciding not to optimize a flood. How many months are you willing to pay this opportunity cost?

?subject=Help me improve my flood using Optiflood&body=Help me improve my flood using Optiflood. I understand Optiflood is a process that incorporates learnings from improving 200 floods.%0D%0A%0D%0AMy Name ________________%0D%0AMy Phone number _____________%0D%0AField ______________%0D%0APool_______________%0D%0A(Or call Proven Sales at 403-803-2500.)">Contact Proven for their experience at using Optiflood to improve over 200 floods.

Charles Koch said, “A good businessman doesn’t use fixed costs, nor does he use incremental costs. He uses real costs and he thinks about what that means.”

If your flood has not been optimized for years, the technical debt may also robbing you of cash flow.

But you are not alone. Alberta operators are losing $10 billion per year from unoptimized floods.

What is opportunity cost?

Opportunity cost is the benefit of the next most attractive alternative. It is the cost of choosing one alternative compared to the benefit what you could have chosen.

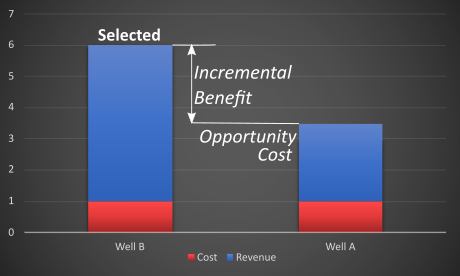

For example, let us consider two investment alternatives: Drilling well A or well B.

Well A costs $1 million to drill and provides income of $3.5 million.

Well B also costs $1 million to drill but provides income of $6 million.

You would naturally choose to drill Well B. The opportunity cost is the $3.5 million -- return of Well A. Well B is $2.5 million better than Well A.

The cost of choosing is leaving behind another choice.

?subject=I just want one historic application. Cheap and cheery.&body=Send me the documents for one historic application%0D%0A%0D%0AMy Name: __%0D%0AMy Phone Number: ___%0D%0A%0D%0AApplication number: __%0D%0A%0D%0A(Or call Proven Sales at 403-803-2500.)%0D%0A%0D%0APricing: https://www1.appintel.info/order-application-on-demand">Contact us for historic applications. Cheap and cheery.

Benefit is a Cost?

It is easy to get confused when one hears that opportunity cost of one choice

is a benefit from another choice.

How can a benefit of one alternative be the cost of another?

When you choose an investment, it should be better than any other alternative. The next best alternative defines the opportunity cost. Opportunity cost is the alternative you forego.

Even if you could afford to choose all alternatives, you would naturally start with the best one. If you chose anything but the best, the cost of leaving it behind is too high.

Flood optimization is more economic than most other common investments in the oil and gas business.

Flood optimization is more economic than other investments

| Investment Metric | Optimize Flood | Replace an ESP | Drill a Hz Well | |

| PIR | $/$ | 240 | 5 | 5 |

| acquisition cost | $k/bopd | 0.3 | 4.0 | 15.0 |

| Payout | mos | 0.2 | 2.4 | 9.0 |

Opportunity cost applied to discounted cash flow

The benefit of investing in risk-free Canadian T-Bills is about 1% return. Any other alternative investment must have a better benefit than this risk free return.

If an alternative investment won't make better than 1% return, why not invest in T-Bills?

The opportunity cost of investing becomes the cost of capital or discount rate.

But oil and gas operators believe drilling wells is a more risky investment than T-Bills. They demand a higher rate of return to offset that risk.

Opportunity cost must be adjusted for risk. Canadian government thirty-year bonds have a return of 4% because they are more volatile and therefore more risky than a T-Bill.

Oil and gas operators are currently using a weighted average cost of capital (opportunity cost) between 6 and 20%.

?subject=Sign me up for a one day trial&body=Sign me up for a one day trial of AppIntel so I can check out risk mitigation technology.%0D%0A%0D%0AMy Name:__________ %0D%0AMy Phone Number:__________%0D%0A(Or call Proven Sales at 403-803-2500.)%0D%0A%0D%0APricing: https://www1.appintel.info/short-term-search/">Contact Us for a one day trial of AppIntel.

Opportunity cost applied to oil and gas field investments

Consider drilling a well: The well must provide a better return than other investments. If not, why drill it?

But drilling a well is risky. Its risked benefit should provide a better return than other investments with similar risk.

Consider a well workover: The operation must provide a better return than other investments. If not, why perform the workover?

A well workover has less risk than drilling. Compared to drilling, if a workover risk is lower and the rate of return is higher, wouldn't you perform a workover first?

Flood optimization has a large benefit and a low cost. Optimizing a flood can provide a better return than either a workover or drilling a well.

Tags: Flood, Cut costs

Granger Low 20 Oct 2022

Granger Low 20 Oct 2022

Energy industry badly needs AI for growth

But chatbots are giving AI a bad name

Pacify the picky regulator

They want all the details

The paradigm shift your competition hopes you ignore

How will you keep up with a once-in-a-generation investment opportunity?

LLM more trendy than LNG?

Large Language Model for oil and gas

Too busy to use oil and gas AI?

Then you are too busy to add oil and gas production quickly

How do we train the millennial oil and gas knowledge worker?

How will they stay current? How will they add more oil and gas?

Prevent SAGD Breakthrough

And see his net pay maps

The shortcut that could end your career and your company

Don’t start or optimize secondary recovery without expert help

Oil and gas will not tolerate AI hallucinations

AI for the industry must be trustworthy

Making more oil in a world where AI accelerates change like never before

Flooding the tight Montney

AI helps Oil and Gas be wiser than Solomon

AI based in truth, not pop culture

Mitigating Induced Seismicity – Calm on the surface

Not shaken. Not even stirred.

Yogi vs. Granger - AI impediments to resolve for AI success in oil and gas

Yogi Schulz and Granger Low face off over AI adoption

Amid tariff uncertainty, Canadian well applications grow again

AppIntel AI leading indicators suggest operator optimism

AppIntel AI blog has delivered over 1 million pages views

Artificial Intelligence for the oil and gas industry

Getting flexibility in plant sulfur emissions

Sometimes it's all in the math

Haters know something you don't

Using the regulator to bully and save $3 million

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share