The future blockchain of oil and gas marketing

Trading anonymously: big volatility in oil and gas prices

Blockchain technology cryptocurrencies have boosted volatility in trading circles.

Blockchain technology cryptocurrencies have boosted volatility in trading circles.

The graphics cards used to mine cryptocurrency are in short supply.

But how will the disruptive blockchain technology impact the oil and gas industry?

Blockchain prediction

The oil and gas industry will see a decentralized oil and gas trading system based on blockchain technology within the next five years.

The first one will be released to the public domain by an open source programmer who will create it as a challenge. After it is released, the original programmer will have no more control over it. He or she will not profit much from it.

Prepare for it. There will be a public domain oil and gas marketing platform based on blockchain technology. It will create tremendous volatility in the price of oil and gas.

Anonymous trading platform

Buyers and sellers will use any currency on the globe including US dollars, Chinese Yuan, Bitcoin and Ethereum to buy and sell oil and gas.

The first version will likely be a trading platform for natural gas or condensate. But future versions will include marketing platforms for Edmonton Light, and Edmonton Sweet Mix, and MSB or any fluid from any place.

Trust is a major requirement for buying and selling oil and gas. Would you buy 10,000 barrels of oil from someone you didn't believe would deliver?

Hurdles to a blockchain oil and gas trading platform

The hurdles will include getting the regulators to allow crude oil products to be transferred to the trading site. The Alberta government will still get their royalties, but the Federal government will have a more difficult time tracking GST and trader income tax.

Another hurdle will be dealing with pipeline companies.

A big hurdle will be protecting the 'wallet' in which traders will keep their trading funds. Currently trades of cryptocurrencies is secure, but the wallets get stolen.

Would you invest in blockchain technology?

Investors are looking for the next application of new blockchain technology. Blackrock, Inc. published a blockchain investment commentary last week. Bluesky Equities is advertising for an analyst that can predict the next use of blockchain.

Blockchain technology is the innovation behind cryptocurrencies like BitCoin, Ethereum and Oleum. For a primer on blockchain technology, see Blockchain -- Market Disruption below.

Advantages of a blockchain trading platform

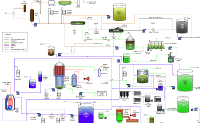

A trusted decentralized oil and gas marketing system using blockchain will allow oil and gas producers to sell directly to consumers anywhere in the world without central clearinghouses like the Chicago Mercantile Exchange or NGX.

Blockchain technology will ensure that oil and gas commodity sales are trusted. Blockchain warrants that the sellers truly have the barrels and gigajoules to sell.

Blockchain technology also allows buyers to purchase oil and gas in any currency that sellers will accept including cryptocurrencies, US dollars, Chinese Yuan or Saudi Riyal.

Blockchain oil and gas sales can be anonymous. Since there is no central clearinghouse company, trading fees will be much smaller than the current 5¢ per cubic meter.

Blockchain -- Market Disruption Technology

Blockchain is the disruptive technology that has enabled successful cryptocurrencies. For a primer on cryptocurrency see Cryptocurrency - Money Without Borders below.

Blockchain technology is a electronic ledger kept on hundreds of computers. The computers constantly check the ledgers to ensure they all say the same thing. Each transaction record contains a checksum of all the previous records in the form of a hash.

If a transaction record doesn't have the same hash as all the other ledger copies, that ledger is excluded from the authority group.

If the ledgers all agree that Kendall possesses 100 Bitcoins in his wallet, he is free to sell those to someone else. The transaction is recorded on the distributed ledgers with the blockchain hash.

Anyone can contribute a computer to mine Bitcoins. A computer that mines gets a small fixed commission per transaction processed.

When a computer starts mining, it copies the longest blockchain available.

Cryptocurrency - Money Without Borders

Cryptocurrency should really be called money without centralization.

Currency such as British Pounds or Canadian Dollars are issued by a central bank. Canadian Dollars are issued by the Bank of Canada who determines the size of the money supply and controls interest rates by lending to chartered banks using the overnight rate.

A cryptocurrency has no central bank or single institution to control its value. This allows Bitcoin to be used in any country to buy anything from a vendor who will accept it as tender. This lack of central control also creates tremendous volatility in the value of the cryptocurrency.

But if there is no central monetary authority, what is to stop Kendall from buying 100 Bitcoin and selling 300?

Enter blockchain technology.

When Kendall buys 100 Bitcoin from a vendor, the transaction is recorded in the distributed ledger. When Kendall attempts a transaction to sell 100 Bitcoin, the transaction is checked on the blockchain distributed ledger to ensure he has 100 to sell much the same way a credit card reader checks a Visa card.

Sixty-six new crypto currencies have been listed through an ICO in the last thirty days.

Granger Low 12 Mar 2018

Granger Low 12 Mar 2018

Supercharge 2026 with exploration AI skills that matter

Found a corner shot in thermal scheme

Don't blow the lid

Fracking into a neighboring well causes a blowout

Continuing Canadian thermal innovation doubled oil production

Experimental Propane Solvent co-injection in thermal

Shale in SAGD

How shale much is too much shale? Ask AppIntel AI.

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI shows SAGD type logs

Check out the picks and cap rock

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

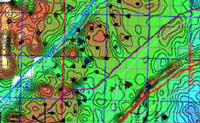

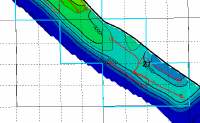

AI provides access to regional seismic mapping

Find it with AppIntel AI

New flood to double reserves for heavy oil pool

The age of water floods is not over

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share