Acquisition scouting with AppIntel AI

Make your move to the corner office

Regulatory applications contain plans, justifications and pitfalls of conventional and heavy oil schemes. Would finding these in proximity to your oil field interests help you in your acquisition process?

Regulatory applications contain plans, justifications and pitfalls of conventional and heavy oil schemes. Would finding these in proximity to your oil field interests help you in your acquisition process?

AppIntel can show opportunities that have already been justified in detail with the regulator.

AppIntel can also show bear traps and compliance problems and their details.

?subject=I want a cheap and cheery one day trial of AppIntel&body=Sign me up fro a one day AppIntel trial so I can check out closure statistics. %0D%0A%0D%0AMy Name:___%0D%0AMy Phone Number:____%0D%0A%0D%0AType of applications:___%0D%0A%0D%0APricing: www.appintel.info/short-term-search/%0D%0A%0D%0A(Or call AppIntel Sales at 403-803-2500.)">Let us help you move to the corner office.

- In this article:

- Using AppIntel AI for acquisition scouting

- Example

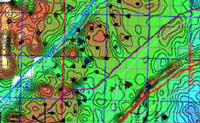

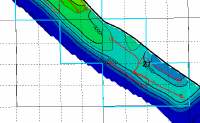

- Proximity screen shots

- Will it make a difference?

- Justin moved to the corner office

Example:

Justin from ABC Oil and Gas Ltd. acquired a property from another operator.

After he consummated the purchase, he searched for the property's applications in AppIntel. He found development plans to double the number of wells with horizontal locations picked, pressures discussed and incremental recovery factor already proposed. None of this upside information was in the data room.

By ratifying and presenting this new found upside, he became MVP in the company.

What value would it add to your acquisition if you always had a handle on all the upside (and downside)?

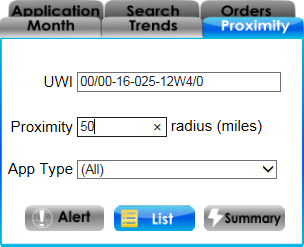

Proximity Screen Shots:

AppIntel's proximity tools is much more effective than any other similar tools.

To use the Proximity tab in AppIntel.

Set the UWI as the center of your acquisition.

Set the Proximity at 50 miles (or less).

Set the App Type to (All) or a specific application type such as ER Scheme, GPP, or Commerical Scheme: New. (See below)

List button.

All the applications in that area of interest are displayed. (See below)

| Application | Attach | Type | Applicant | Registered | Pool |

|---|---|---|---|---|---|

| 820927 | View | CCP | Sundance Oil Canada Ltd. | 1982-09-24 | Banff B |

| 870989 | View | CCP | Westmin Resources Limited | 1987-07-07 | Banff B |

| 871520 | View | CCP | Tintagel Energy Corporation | 1987-10-02 | Banff B |

| 1000379 | View | Spacing: Oil | GULF CANADA RESOURCES LIMITED | 1996-02-20 | |

| 1000401 | View | GPP | GULF CANADA RESOURCES LIMITED | 1996-02-27 | LOWER MANNVILLE GG |

| 1000507 | View | GOR Penalty Rlief | HUSKY OIL OPERATIONS LIMITED | 1996-03-22 | MANNVILLE W5W |

| 1000554 | View | CCP | HUSKY OIL OPERATIONS LIMITED | 1996-04-08 | UPPER MANNVILLE RRR |

If you wish, you can also set an area alert to have AppIntel notify you of future applications in this area.

?subject=I want a cheap and cheery one day trial of AppIntel&body=Sign me up fro a one day AppIntel trial so I can check out closure statistics. %0D%0A%0D%0AMy Name:___%0D%0AMy Phone Number:____%0D%0A%0D%0AType of applications:___%0D%0A%0D%0APricing: www.appintel.info/short-term-search/%0D%0A%0D%0A(Or call AppIntel Sales at 403-803-2500.)">Contact us now for a one day trial.

Will it make a difference?

Your wells are like the average conventional oil well in Alberta that produces 30 bopd.

You can buy production or sell production for $50 thousand per flowing boe per day. (Sometimes acquisition/divestiture engineers use this as a rule of thumb.)What value would it add to your acquisition if you could find extra upside from old AER applications?

If you could add just 15% more recovery on a hundred well acquisition, you could add over 20 million dollars in NAV.

100 wells x 30 bopd x 15% x $50 M/boepd = $22,500 M

Justin moved to the corner office.*

He used AppIntel to find out his acquisition's plans and problems. He used them to set plans to drill 15 more wells than were recognized in the acquisition forecast.

Want to know what the operator has justified to the AER in the past on your acquisition project?

Want to see how the regulator reacted to their plans?

Want to exploit past ideas that were lost on previous acquisitions?

KNOW ALL THE UPSIDE OF YOUR ACQUISITION

*power fantasies may vary.Tags: AppIntel advantage, Acquisitions, AI in oil and gas, AI return on investment

Granger Low 15 Feb 2015

Granger Low 15 Feb 2015

Supercharge 2026 with exploration AI skills that matter

Found a corner shot in thermal scheme

Don't blow the lid

Fracking into a neighboring well causes a blowout

Continuing Canadian thermal innovation doubled oil production

Experimental Propane Solvent co-injection in thermal

Shale in SAGD

How shale much is too much shale? Ask AppIntel AI.

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI shows SAGD type logs

Check out the picks and cap rock

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

AI provides access to regional seismic mapping

Find it with AppIntel AI

New flood to double reserves for heavy oil pool

The age of water floods is not over

AppIntel AI finds three corner shots

Can you see them?

Flood repatterning

Extended life support

AppIntel AI shows maps of neighbor's complex geology

In a flood of a commingled pool

AI makes opportunity more accessible than conferences

Which sources of technical information do you trust?

Repairing microannulus in thermal wells

Check out the 4D seismic chamber thickness map

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share