4 reasons you might blame the Alberta recession on SAGD

But it's not SAGD's fault

Okay, the recession was not likely sparked solely by SAGD. There may have also been contributions by fracking technology, rising Russian oil supply, and an echo of the global financial crisis. We can spread the blame around.

Okay, the recession was not likely sparked solely by SAGD. There may have also been contributions by fracking technology, rising Russian oil supply, and an echo of the global financial crisis. We can spread the blame around.

Despite the four reasons, some local operators still have big plans for SAGD. Most thermal operators that are continuing are finding ways to reduce the cost structure and improve the economics of bitumen recovery.

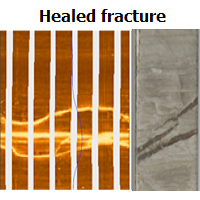

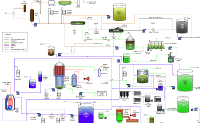

In fact, just a few months ago, one operator applied for a new SAGD operation. They believe that SAGD is viable. As a bonus, they included an interesting technical discussion of cap rock fracturing.

Help yourself to their applications document through our self-serve portal.

Get details of this cool tech Subscribers get them for freeWithout AppIntel, you would not get an email notification every time a new SAGD application is submitted. You would need to go looking for any new activity by yourself.

Look back at the field trials of others

It makes sense to see what others have done in the field. A field "look back" needs to consider the operator's intentions and their actual results.

Technical papers are fine. Simulations are great. But actually seeing infill strategies in the field takes the surprises out of the equation.

The best way to conduct a look back is to read the application documents of others. These documents show their intentions and promises to the regulator.

?subject=Help me review new thermal bitumen recovery technology&body=Help me reviewing new thermal bitumen recovery technology%0D%0A%0D%0AMy Name:__________ %0D%0AMy Phone Number:__________ %0D%0A%0D%0A(Or call Proven Sales at 403-803-2500.)">Contact Proven for support. We keep abreast of all the new thermal technology.

They also indicate the actual UWI locations of the proposed operation. Using these locations, you can review injection and production history and draw your own conclusions about success or failure of the field trial.

4 reasons you might blame the Alberta recession on SAGD

1. SAGD and other thermal bitumen technologies have performed poorer than expected. Thermal recovery has performed well, but not as well as we all hoped. This is one of the reasons that Shell, ConocoPhillips, Statoil, ExxonMobil, Marathon, Koch and Imperial have all abandoned their Western Canada bitumen assets selling them to local Canadian operators.

The current provincial political climate toward the oil industry may also have contributed to the exit of these multi-national corporations.

But, as Charles Koch is fond of saying, when one company sells, another company is buying. Someone thinks bitumen assets are worthwhile, if at a lower acquisition price.

2. The additional world oil supply from SAGD. Oil production from oil sands has tripled in the last 15 years. And it is forecast to quintuple over the next twenty years. Additional marginal supply tips the scales toward over-supply, dropping oil prices. When oil prices drop, oil companies tend to spend less capital which hurts suppliers of steel, pipe and facilities.

3. SAGD is very capital intensive. For many years, it has been gobbling up much of the capital investment available to the oil industry.

4. SAGD has been attracting much of the foreign capital. Far east capital has been attracted to SAGD because of its long life supply. Full cycle economics may no longer be attractive for thermal mega-projects, but keeping SAGD fields producing certainly seems attractive for most operators.

We've given you 4 reasons that SAGD might be blamed for a recession. Can you think of more?

But its not SAGD's fault

Certainly other factors in the recession of Alberta's economy include:

1. Adversarial political climate toward the oil and gas industry in Alberta.

2. US stockpiling of oil in storage at low oil price.

3. Increasing production from Russia.

4. Skiddish investor outlook for global oil demand.

5. Shortage of pipeline export capacity.

6. High cost of oil and gas regulation in Western Canada.

Fixing the problem rather than fixing the blame

Now that the capital structure of most SAGD schemes is reduced, you owe it to yourself and your investors to read the application documents that explore the thermal projects of others. You decide whether they will work for your field.

Reducing the cost of thermal projects and improving the recovery will continue to take field experimentation through the next decade. Watching the applications of your competitors will allow you to quickly copy their successes and avoid their failures.

?subject=I want a one day trial of AppIntel to research applications like mine&body=Sign me up for a one day AppIntel trial so I can check out thermal applications like mine. I want to to see their technology.%0D%0A%0D%0AMy Name:___%0D%0AMy Phone Number:____%0D%0A%0D%0AType of applications:___%0D%0A%0D%0APricing: https://www1.appintel.info/short-term-search/%0D%0A%0D%0A(Or call AppIntel Sales at 403-803-2500.)">Contact us now to try it cheap and cheery.

Tags: Thermal, Heavy Oil

Granger Low 14 Aug 2017

Granger Low 14 Aug 2017

Experimental Propane Solvent co-injection in thermal

Continuing Canadian thermal innovation doubled oil production

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

New flood to double reserves for heavy oil pool

The age of water floods is not over

Flood repatterning

Extended life support

AI makes opportunity more accessible than conferences

Which sources of technical information do you trust?

Repairing microannulus in thermal wells

Check out the 4D seismic chamber thickness map

In-house AI attempts fail-80%

Spin off your in-house AI attempt

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share