Flood still not optimized? The opportunity cost is high.

Always choose the best return.

Deciding where to invest? Optimizing floods provides the best return in the basin.

Optimizing floods is a much cheaper way to increase production than drilling. If you ignore flood optimization you face a huge opportunity cost.

Deciding where to invest? Optimizing floods provides the best return in the basin.

Optimizing floods is a much cheaper way to increase production than drilling. If you ignore flood optimization you face a huge opportunity cost.

Opportunity cost is the rate of return of the next most attractive alternative.

This blog post is brought to you by Proven Reserves Exploitation, one of our information partners. Nein commercial use of der AppIntel content.

One operator chose to drill a well in a costly, restricted area because he expected a large prize -- even on a risked basis. The opportunity cost was the smaller return of drilling wells in an easier locale. So he decided to drill this expensive critically sour well in a recreational area taking all the extra environmental care and bearing the extra cost.

See his drilling plans in his application documents from our self-serve portal.

Get details of this cool tech Subscribers get them for freeLosing cash flow by not optimizing a flood: Opportunity cost

For every month an operator puts off optimizing her flood she forfeits the opportunity cost of half a million dollars or 300 bopd.

| If an operator chooses not to optimize a flood, the opportunity cost is $500k/month | ||

| 300 | bopd | Incr prod |

| $6,000 | k cf/y | Incr cash flow |

| $500 | k cf/mo | Incr cash flow |

| $500 | k cf/mo | Opportunity cost |

The opportunity cost is the lost cash flow from deciding not to optimize a flood. How many months are you willing to pay this opportunity cost?

?subject=Help me improve my flood using Optiflood&body=Help me improve my flood using Optiflood. I understand Optiflood is a process that incorporates learnings from improving 200 floods.%0D%0A%0D%0AMy Name ________________%0D%0AMy Phone number _____________%0D%0AField ______________%0D%0APool_______________%0D%0A(Or call Proven Sales at 403-803-2500.)">Contact Proven for their experience at using Optiflood to improve over 200 floods.

Charles Koch said, A good businessman doesnt use fixed costs, nor does he use incremental costs. He uses real costs and he thinks about what that means.

If your flood has not been optimized for years, the technical debt may also robbing you of cash flow.

But you are not alone. Alberta operators are losing $10 billion per year from unoptimized floods.

What is opportunity cost?

Opportunity cost is the benefit of the next most attractive alternative. It is the cost of choosing one alternative compared to the benefit what you could have chosen.

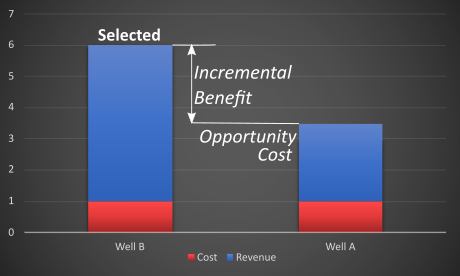

For example, let us consider two investment alternatives: Drilling well A or well B.

Well A costs $1 million to drill and provides income of $3.5 million.

Well B also costs $1 million to drill but provides income of $6 million.

You would naturally choose to drill Well B. The opportunity cost is the $3.5 million -- return of Well A. Well B is $2.5 million better than Well A.

The cost of choosing is leaving behind another choice.

?subject=I just want one historic application. Cheap and cheery.&body=Send me the documents for one historic application%0D%0A%0D%0AMy Name: __%0D%0AMy Phone Number: ___%0D%0A%0D%0AApplication number: __%0D%0A%0D%0A(Or call Proven Sales at 403-803-2500.)%0D%0A%0D%0APricing: https://www1.appintel.info/order-application-on-demand">Contact us for historic applications. Cheap and cheery.

Benefit is a Cost?

It is easy to get confused when one hears that opportunity cost of one choice

is a benefit from another choice.

How can a benefit of one alternative be the cost of another?

When you choose an investment, it should be better than any other alternative. The next best alternative defines the opportunity cost. Opportunity cost is the alternative you forego.

Even if you could afford to choose all alternatives, you would naturally start with the best one. If you chose anything but the best, the cost of leaving it behind is too high.

Flood optimization is more economic than most other common investments in the oil and gas business.

Flood optimization is more economic than other investments

| Investment Metric | Optimize Flood | Replace an ESP | Drill a Hz Well | |

| PIR | $/$ | 240 | 5 | 5 |

| acquisition cost | $k/bopd | 0.3 | 4.0 | 15.0 |

| Payout | mos | 0.2 | 2.4 | 9.0 |

Opportunity cost applied to discounted cash flow

The benefit of investing in risk-free Canadian T-Bills is about 1% return. Any other alternative investment must have a better benefit than this risk free return.

If an alternative investment won't make better than 1% return, why not invest in T-Bills?

The opportunity cost of investing becomes the cost of capital or discount rate.

But oil and gas operators believe drilling wells is a more risky investment than T-Bills. They demand a higher rate of return to offset that risk.

Opportunity cost must be adjusted for risk. Canadian government thirty-year bonds have a return of 4% because they are more volatile and therefore more risky than a T-Bill.

Oil and gas operators are currently using a weighted average cost of capital (opportunity cost) between 6 and 20%.

?subject=Sign me up for a one day trial&body=Sign me up for a one day trial of AppIntel so I can check out risk mitigation technology.%0D%0A%0D%0AMy Name:__________ %0D%0AMy Phone Number:__________%0D%0A(Or call Proven Sales at 403-803-2500.)%0D%0A%0D%0APricing: https://www1.appintel.info/short-term-search/">Contact Us for a one day trial of AppIntel.

Opportunity cost applied to oil and gas field investments

Consider drilling a well: The well must provide a better return than other investments. If not, why drill it?

But drilling a well is risky. Its risked benefit should provide a better return than other investments with similar risk.

Consider a well workover: The operation must provide a better return than other investments. If not, why perform the workover?

A well workover has less risk than drilling. Compared to drilling, if a workover risk is lower and the rate of return is higher, wouldn't you perform a workover first?

Flood optimization has a large benefit and a low cost. Optimizing a flood can provide a better return than either a workover or drilling a well.

Tags: Flood, Cut costs

Granger Low 20 Oct 2022

Granger Low 20 Oct 2022

Experimental Propane Solvent co-injection in thermal

Continuing Canadian thermal innovation doubled oil production

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

New flood to double reserves for heavy oil pool

The age of water floods is not over

Flood repatterning

Extended life support

AI makes opportunity more accessible than conferences

Which sources of technical information do you trust?

Repairing microannulus in thermal wells

Check out the 4D seismic chamber thickness map

In-house AI attempts fail-80%

Spin off your in-house AI attempt

Facility fugitive emissions scrutiny

Keep your eye on the horizon of oil and gas change

AI predicts the future for 2026

using leading indicators

Celebrating 2025, a year of innovation

Oil and gas paradigm shifts this year

RTF: Most refused submission type in November

Leading indicators from industry

Astrobleme impacts deep well disposal scheme

Learn from the experience of other operators

Non-meridian thermal wells

Still drilling horizontal wells N‑S? Why?

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share