Gas injection woes worse than COVID woes?

Injecting gas is not always the solution. Are you sure about the problem?

What if cost to tie-in solution gas is more expensive than the gas revenue it brings? And how do you convince the regulator that you don't need to tie in?

What if cost to tie-in solution gas is more expensive than the gas revenue it brings? And how do you convince the regulator that you don't need to tie in?

When his solution gas pipeline broke, one operator hoped to inject natural gas into his oil formation.

But he found that the regulatory process for approval to inject was not in his favour. His application was rejected by the regulator — several times.

Find out why. Get his application documents in moments from our self serve delivery service.

Get details of this cool tech Subscribers get them for freeWithout AppIntel, how would you quickly find the applications the AER closes — how many applications refused and why? With AppIntel it is easy. Just look at the closure statistics trend tab. With one click you can drill down into the rejected applications and see the reasons for rejection. Nein commercial use of der AppIntel content.

Without conserving gas this operator feared he would be required to shut in his oil production. There are many ways of getting the approval he needed. But he was not interested in our advice.

?subject=I want a one day trial of AppIntel to research closed applications&body=Sign me up for a one day AppIntel trial so I can check out closed applications. I want to ensure my applications are approved.%0D%0A%0D%0AMy Name:___%0D%0AMy Phone Number:____%0D%0A%0D%0AType of applications:___%0D%0A%0D%0APricing: https://www1.appintel.info/short-term-search/%0D%0A%0D%0A(Or call AppIntel Sales at 403-803-2500.)">Contact us now to find closed applications

Why inject gas?

No matter what they say about enhanced recovery, many oil operators have started re-injecting natural gas into oil reservoirs hoping to avoid MRL curtailment.

And many gas operators have stated re-injecting natural gas into rich gas reservoirs hoping to recover more natural gas liquids.

Saving the capex and opex cost of treating and transporting natural gas is also a primary driver to injecting gas.

The real reason

But the real reason companies are injecting gas is less about enhanced recovery and more about something else.

Natural gas liquids are valuable. Natural gas is not.

The greatest reason behind most gas injection schemes is to dispose of gas.

Um okay, dispose is not the right word. The regulator doesn't want to hear about anyone disposing gas.

The greatest reason behind most gas injection schemes is to conserve gas. For later. Deep in a reservoir.

And if the conserved gas becomes more valuable in the future, it can always be produced again from the very tight formation.

?subject=Help me get up to speed on solution gas re-injection&body=Help me get up to speed on solution gas re-injection.%0D%0A%0D%0AMy Name:__________ %0D%0AMy Phone Number:__________ %0D%0A%0D%0A(Or call Proven Sales at 403-803-2500.)">Contact Proven for support. We watch the new ideas of the industry.

Gas injection a good idea?

Not everyone believes injecting gas is a good idea. It is not as cheap as one might think.

The wellhead pressure for gas injection is sky high. More compression will be needed.

Injecting gas and water in the same wellbore has rarely worked in the past. Gas often segregates in the wellbore and soon raises the well injection pressure.

And the regulator believes gas injection presents more risk of casing failure than water injection.

Gas revenue down

Currently a triple-whammy pushes gas revenue for operators down. First, gas prices are very low. Second processing costs are up. And lastly, solution gas presents poor economies of scale.

Markets for natural gas exist, but the price has been very low over the last few years. Liquids prices have been more favourable.

A trend for producers to sell mid-stream facilities to raise money has steeply increased the cost of gathering and processing natural gas.

Oil wells typically produce small volumes of natural gas. Low economy of scale makes capital and operating costs of conservation very expensive.

Changes in regulatory policy

Changes in regulatory policy

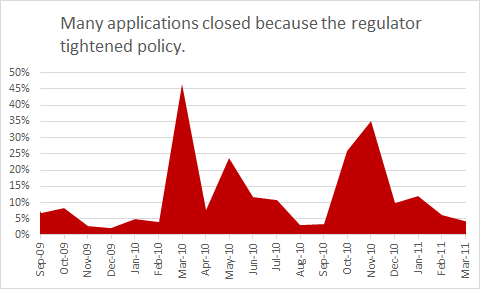

Closure statistics indicate when the regulator changes regulatory policy.

A very clear example was in mid 2010. The regulator changed policy but didnt change the written regulations. Over the next few months they rejected almost half of the application registered.

?subject=I want a one day trial of AppIntel&body=Sign me up for a one day AppIntel trial so I can check out closure statistics. %0D%0A%0D%0AMy Name:___%0D%0AMy Phone Number:____%0D%0A%0D%0AType of applications:___%0D%0A%0D%0APricing: https://www1.appintel.info/short-term-search/%0D%0A%0D%0A(Or call AppIntel Sales at 403-803-2500.)">Contact us now for a one day trial.

History repeats itself

This problem has plagued Alberta oil and gas companies since the 1940s. In those days the solution gas was flared at the Turner Valley field. There was no market for natural gas.

The public was outraged. The natural gas which belonged to the people of Alberta was being squandered for the sake of economic expediency. There was an outcry fot the government to do something.

So the Alberta government formed the Energy Resources Conservation Board. It was given authority to restrict flow from oil wells unless solution gas was conserved. Maximum rate limitations (MRL) were imposed on every well that was flaring or venting natural gas.

Oil companies of the day earned their social licence to continue production by shutting in gassy production, tieing-in gas wells, finding markets for natural gas, and injecting natural gas for enhanced recovery. Disposal of natural gas was not allowed.

Different century. Same problem.

Granger Low 29 Dec 2020

Granger Low 29 Dec 2020

Experimental Propane Solvent co-injection in thermal

Continuing Canadian thermal innovation doubled oil production

Measuring the rate of oil and gas technology growth

Energy transition inside the oil industry

The rise of water recycle

Join or perish

AppIntel AI hit alerts

Ignite your insight

Blowdown and NCG injection

SIRs often reveal more than submissions

AppIntel AI contains much more than technical papers

More current. More coverage. More detail. More trusted.

New flood to double reserves for heavy oil pool

The age of water floods is not over

Flood repatterning

Extended life support

AI makes opportunity more accessible than conferences

Which sources of technical information do you trust?

Repairing microannulus in thermal wells

Check out the 4D seismic chamber thickness map

In-house AI attempts fail-80%

Spin off your in-house AI attempt

Facility fugitive emissions scrutiny

Keep your eye on the horizon of oil and gas change

AI predicts the future for 2026

using leading indicators

Calgary, Alberta, Canada

Calgary, Alberta, Canada

Share

Share